LATEST UPDATES

-

Personality

Bobby Brown Net Worth: Formed New Edition at 12, Entitled to Whitney Houston’s Legacy, Now on a Legacy Tour. Is His Net Worth $2 Million?

Bobby Brown is an R&B icon with a unique melodic voice, incredible stage presence, and a dark side that has…

Read More » -

Personality

Buster Murdaugh Net Worth: Facing More Legal Issues After His Father, Alex Murdaugh, Killed His Brother and Mother. Is He Really Worth $5 Million?

The true Buster Murdaugh’s net worth can be a huge surprise for many, given his young age. However, the multi-million…

Read More » -

Personality

How Old Is Luh Tyler? Exploring the Age of the Rapper Who Changed His Life by Releasing the Song ‘Law & Order’ on TikTok

How many teens have you seen recording videos for TikTok? Many young people dream of becoming rich and famous fast,…

Read More » -

Personality

Aniya Wayans: Daughter of Damon Wayans Jr., Her Mother Also Had a Son with the Now-Married Dwyane Wade

Some people believe being born to celebrity parents means you’ll grow up feeling privileged. But Aniya Wayans might disagree. This…

Read More » -

Personality

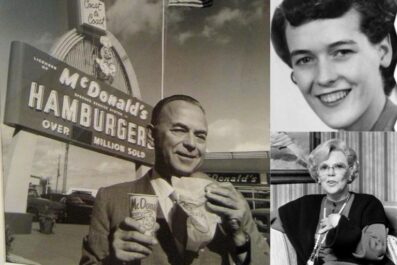

Jane Dobbins Green: Second Wife of McDonald’s Founder Ray Kroc, Not Mentioned in ‘The Founder’ Movie About McDonald’s Rise

Ray Kroc is a familiar name for plenty of people. This man is well-known globally for being the exceptional mind…

Read More » -

Personality

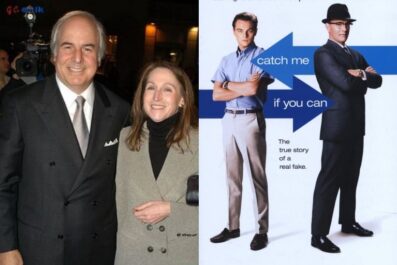

Kelly Anne Welbes Abagnale: Frank Abagnale’s Wife, Whose Husband’s Conman Life Was Portrayed by Leonardo DiCaprio on Screen

I bet you’d agree that Leonardo DiCaprio is phenomenal as the charismatic crook Frank Abagnale Jr. in Catch Me If…

Read More » -

Personality

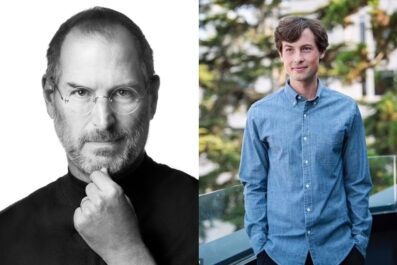

Reed Paul Jobs: Son of Steve Jobs, Excluded from Mother’s Fortune Plans, Yet Launches New VC Firm with $200 Million

Some people speculate that Steve Jobs named his son after Portland’s Reed College, which he attended for a while. Maybe…

Read More » -

Personality

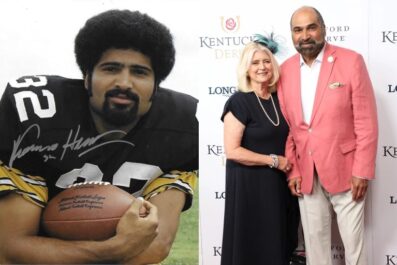

Dana Dokmanovich: Wife of Franco Harris, Renowned for ‘The Immaculate Reception’, Hall of Famer Who Died at 72

Franco Harris is one of the legends of the Pittsburgh Steelers, and he passed away in 2022. Yet, his memory…

Read More » -

Personality

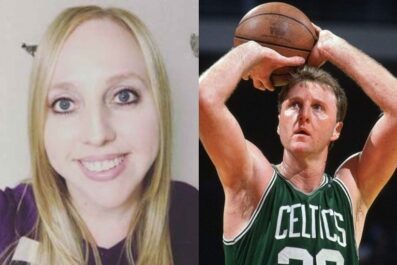

Corrie Bird: Larry Bird’s Daughter, Whose Request to Attend Larry Bird Night Was Denied by Her Father

Larry Bird is an NBA all-star who’s received the coveted Most Valuable Player (MVP) award three times consecutively. On top…

Read More »